By Shahbaz Rana

Published in The Express Tribune on August 18, 2023

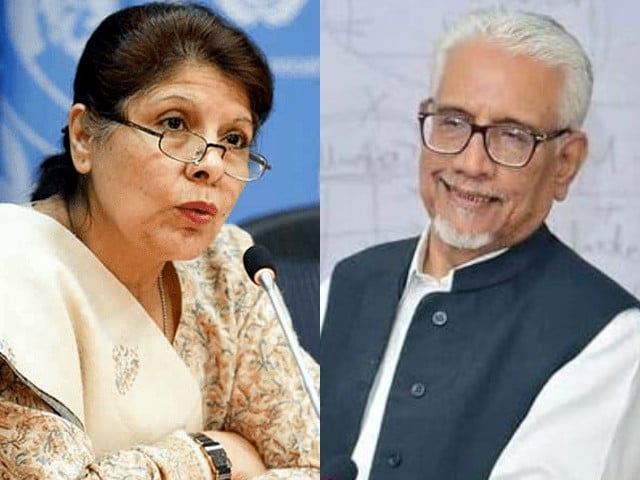

ISLAMABAD: The interim government has picked an experienced duo of Dr Shamshad Akhtar and Dr Waqar Masood Khan to steer the country out of a prolonged economic crisis.

The two new wizards are known for their pro-International Monetary Fund (IMF) stances and liberal policies.

The government has appointed Akhtar as the federal minister of finance, revenue, economic affairs, statistics and privatisation. To assist her, it has also appointed Khan as adviser on finance with the status of the minister of state.

Living up to her reputation, Akhtar showed commitment to the IMF deal and the market-based exchange rate during her maiden meeting with a team of the finance ministry.

Akhtar, a former governor of the State Bank of Pakistan (SBP), has been appointed as the interim finance minister for the second time. Earlier, she was the finance minister during the 2018 caretaker setup and left behind an economic roadmap for the new government of Pakistan Tehreek-e-Insaf (PTI).

But Imran Khan ignored her advice and wasted almost one year before adopting the same path.

She also vowed to bring down inflation and leave behind a fiscal roadmap. Unlike the constitutional limit of three months, it seems the caretaker setup will continue for a longer period and the establishment will look for options to extend the term.

Akhtar had also tried during her last stint to start negotiations with the IMF but she was stopped by the then interim PM, which later proved to be a costly mistake for the country.

Her roadmap had been reported by The Express Tribune on August 19, 2018. Akhtar had advised the new government that if it wanted to avoid an IMF bailout, it should immediately take harsh measures and introduce a steep fiscal adjustment of over Rs600 billion as well as increase interest rate close to double digits.

She advocated 8% currency devaluation, urging the new government to let the rupee fall to Rs135 to the US dollar by June 2019. She also sought an immediate increase in the key policy rate by 200 basis points to 9.5% to curb aggregate demand, which according to her had led to “overheating” of the economy.

The caretaker setup had suggested to the PTI government to take these “reform measures within three weeks”, if it wanted to avoid recourse to the IMF.

The Ministry of Finance stated that Dr Shamshad Akhtar on Thursday officially took over the responsibility of caretaker finance minister.

“Her appointment comes at a critical time, as the nation navigates through economic challenges and strives for stability and growth,” said the finance ministry.

“With an extensive background in finance, economics and development, she is well-equipped to steer Pakistan’s economic policies during this transitional period,” it added.

The ministry stated that the secretary finance gave a detailed briefing on the economic situation and trends of major financial and economic indicators of the country.

The minister was given a run-down about the state of the economy, Pakistan’s commitments to the IMF and the issues being faced by the energy sector whose resolution was critical for a successful completion of the IMF programme.

She inquired about the transactions under the newly established Pakistan Sovereign Wealth Fund.

The first review of the programme is due in November 2023 and its completion will unlock the second tranche of $712 million. She was also briefed about the IMF’s conditions regarding withdrawal of import restrictions and having a market-determined exchange rate.

The minister was given an overview of the commitments under new loans that Pakistan would receive from the Asian Development Bank, World Bank and other financial institutions. She was told about the maturing foreign commercial loans over the next two years.

Key statistics about economic growth, inflation, agricultural credit, trade and remittances were also shared with Akhtar. She was told that the central bank’s reserves stood at $8.1 billion by August 9 but credit to the private sector was negative Rs173 billion by the end of July.