By Shahid Iqbal

Published in Dawn on July 11, 2023

KARACHI: Pakistan lost over $4 billion in remittances sent by overseas Pakistan in FY23, much higher than the amount the PMLN-led coalition struggled to secure from the International Monetary Fund (IMF) during the outgoing fiscal year.

Data issued by the State Bank of Pakistan (SBP) on Monday showed that the remittances month-on-month slightly increased by 4pc to $2.183bn in June while it witnessed a 22pc decline when compared with $2.8bn remittances the country received in June 2022.

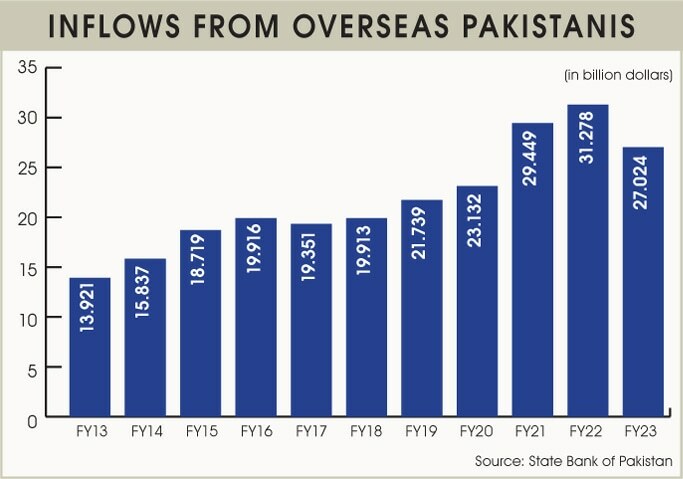

The country received a total of $27.024bn in remittances during FY23 against a record $31.278bn in FY22, a decline of 13.6 or $4.254bn.

The central bank did not offer any reason for the decline of the remittances but analysts said the government’s effort to keep the dollar at lower than actual rates hit the inflows through banking channels.

Over $4bn lost due to rate cap, political and economic uncertainty

The government tried to maintain the dollar-rupee parity at Rs220 in the first half of FY23, which proved counterproductive and the greenback grossly appreciated in the open market resultantly a grey or black market emerged that started offering Rs20 to Rs25 per dollar higher rates badly hitting remittances.

However, the government under IMF pressure uncap the exchange rate on Feb 26 and immediately the dollar jumped to Rs269. With fluctuations in subsequent months, the greenback reached Rs299 in the interbank on May 11 but remained most of the time in the range of Rs280-290.

“During the entire fiscal year FY23, the country remained under the grip of severe political and economic uncertainties which practically weakened both the economy and the currency,” said Atif Ahmed, a currency dealer in the interbank market.

“Along with the price difference, high-interest rates in the international market have also provided an opportunity for the remitters for earning better returns,” said Samiullah Tariq, head of research and development at Pakistan Kuwait Investment Company (Private) Limited.

The largest inflow was from Saudi Arabia but it also fell by 16.9pc to $6.445bn in FY23. In percentage terms, remittances from the UAE witnessed a contraction of 20.5pc to $4.468bn.

Remittances from all important destinations noted a decline except the US which recorded a slight growth of 0.1pc to $3.090bn in FY23. The inflows from the United Kingdom dipped 9.7pc to $4.056bn.

The inflows from GCC and EU countries fell by 12pc and 7pc to $3.191bn and $3.12bn, respectively, during the outgoing fiscal year.