By Salman Siddiqui

Published in Express Tribune on October 11, 2023

KARACHI: The remittances sent home by overseas Pakistanis hit a six-month high at $2.20 billion in September 2023, as expatriate workers increasingly used official channels following a government crackdown on currency smugglers and the illicit Hawala-Hundi traders.

The increase in inflows sparked hopes that the current account deficit would be moderate for the month. Remittances were, however, lower than market expectations of $2.30-2.50 billion.

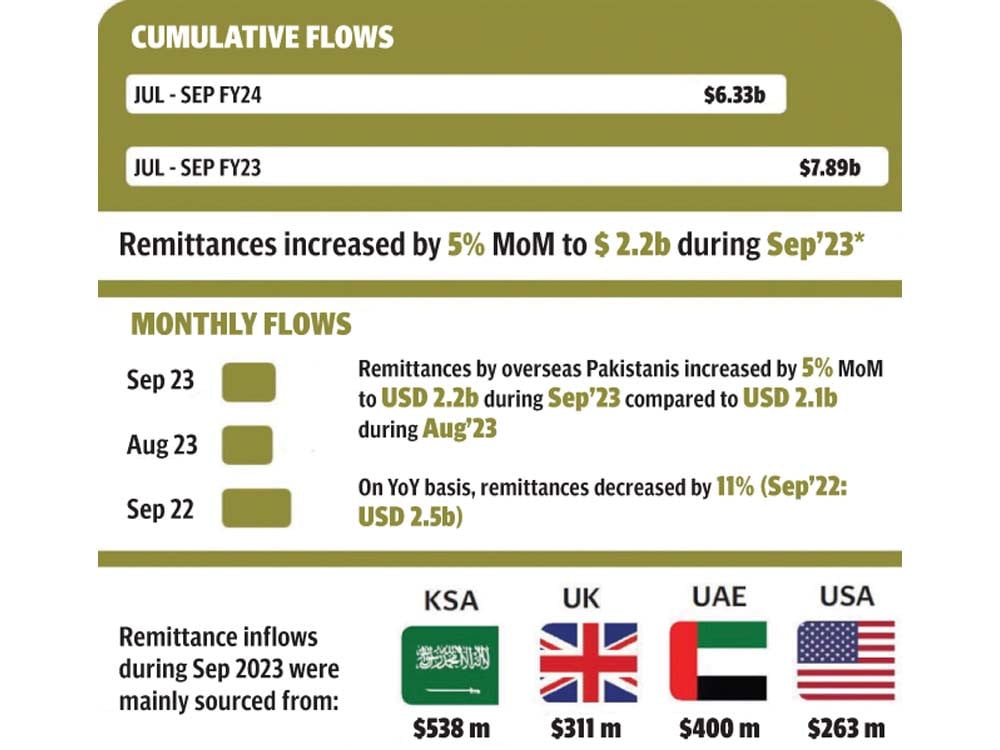

According to State Bank of Pakistan’s (SBP) data, the workers’ remittances improved 5% to $2.20 billion in September compared to $2.09 billion in the previous month. The increase is expected to provide support to the rupee in maintaining its winning streak against the US dollar in both inter-bank and open markets.

On a year-on-year basis, however, the remittances dropped 11% in September compared to inflows of $2.48 billion in the same month of last year.

Overall, in the first quarter (Jul-Sept) of current fiscal year, the inflows dipped 20% to $6.33 billion compared to $7.89 billion in the same period of the previous year.

Talking to The Express Tribune, Pak-Kuwait Investment Company Head of Research Samiullah Tariq said that the government’s crackdown eliminated the illegal currency markets, forcing many overseas Pakistanis to return to official channels for sending money back home to their relatives. He observed a jump of 10-30% in workers’ remittances from the Middle Eastern countries including Saudi Arabia and the UAE where a majority of expatriate Pakistanis were doing jobs and most of the Hawala-Hundi traders were operating.

Inflows remained below market expectations owing to an increase in the rate of return on investments in developed countries, which encouraged the expatriates to park some of their savings in lucrative instruments in western markets. The flow of remittances from the UK and other European countries dropped slightly likely due to recession in the region. He noted that the flow of remittances remained low in other regional countries as well including Bangladesh.

Optimus Capital Management analyst Maaz Azam said that inflows would further improve from next month as the illegal market ran in Pakistan and the Middle East till September 5, 2023 before the launch of crackdown on September 6-7.

He projected that remittances would improve to around $2.40-2.50 billion in October as the government’s action against smugglers borne fruit with the strengthening of rupee-dollar exchange rate to around Rs280/$.

The growth trend for remittances may continue if the authorities concerned do not let the illegal market re-establish itself and the rupee-dollar exchange rate remains stable.

The country’s senior leadership has expressed the resolve to continue the clean-up operation through the crackdown till the illegal networks are fully eliminated so that the exchange rate could stabilise.

Tariq added that the trend suggested Pakistan may realise the full-year remittances target of $31 billion in FY24, which would help keep the current account deficit at a lower level.

Pakistan has projected inflows of $31 billion in its estimates shared with the International Monetary Fund (IMF) for FY24, he said. Tariq pointed out that remittances had played a pivotal role in financing the trade deficit as the authorities decided to keep the total value of imports equivalent to the sum of remittances and export proceeds.

Country-wise inflows

Central bank data showed that the flow of workers’ remittances from Saudi Arabia increased 10% to $538 million in September compared to $491 million in the previous month of August. Expatriates dispatched 30% more remittances at $400 million from the UAE in the month under review compared to $308 million in the previous month.

The non-resident Pakistanis sent $311 million from the UK. Inflows were 6% higher compared to $308 million in the prior month. They remitted 7% lower remittances at $269 million from the European Union compared to $291 million in the previous month. Receipts from the US remained stable at $263 million on a month-on-month basis.

Inflows of remittances improved 3% to $425 million from other countries compared to $412 million in the previous month.