By Shahbaz Rana

Published in The Express Tribune on May 13, 2024

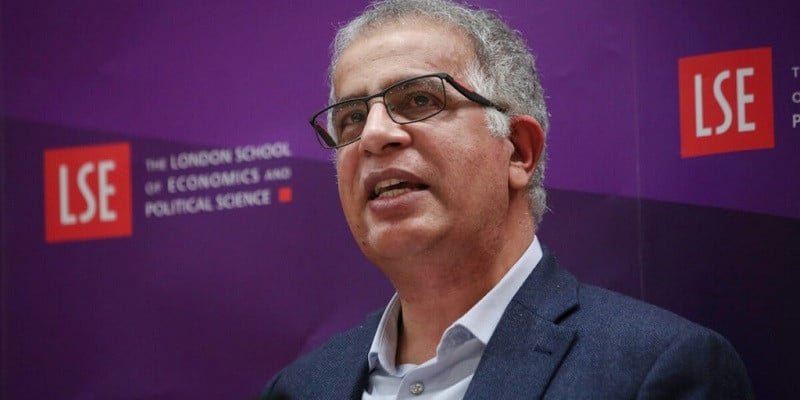

ISLAMABAD: A “normal” country does not need an International Monetary Fund programme but Pakistan’s next few years seem difficult without its support, according to Foreign, Commonwealth and Development Office (FCDO) of the UK Chief Economist Professor Adnan Khan.

In an interview with The Express Tribune, Khan also maintained that Pakistan’s tax system was unjust as the poorest 10% of citizens were paying a larger share of their income in taxes than the richest 10%.

He further suggested that Pakistan should opt for foreign investment only in the export-related sectors. He added that no new investment should be channelled into the power sector.

However, he continued that foreign investment would not come to the country as long as the local investors remained sitting on the fence. “They [local investors] will have to start investing.”

Khan visited Pakistan and held meetings with Prime Minister Shehbaz Sharif, Finance Minister Muhammad Aurangzeb and the business community to better understand the country’s economic trajectory.

He spoke at length with The Express Tribune about Pakistan’s economic ailment and where it went wrong in its history.

“A normal country should not need the IMF,” Khan said while responding to a question.

He, however, observed that Pakistan’s next few years looked difficult without an IMF programme, partly because of a huge fiscal gap and the balance of payments crisis.

Pakistan inking 23 bailout packageswith the IMF and preparing for the 24th one does substantiate Khan’s comments about a country that is not acting normally.

An IMF delegation is already in Pakistan on a fishing mission to gauge the political strength of the government and whether its economic agenda has any substance or not.

Government sources said the IMF would agree to a new bailout package only when it was satisfied with the political strength as well as the credibility of the economic stabilisation plan.

On Saturday, IMF Resident Representative Esther Perez said the global lender’s Pakistan chief Nathan Porter would “meet with the country’s authorities next week to discuss the next phase of engagement.

The FCDO chief economist said the IMF programme was ideally meant to undertake reforms to come out of the crisis mode but it itself would not lead to long-term economic growth.

“The IMF stabilisation programme will provide the necessary conditions that along with other reforms can potentially lead to growth,” he added.

To a question whether or not Pakistan should enter an IMF programme that offered only $6 billion in three years against the required $75 billion, Khan replied that the country’s economic needs were much bigger than the potential size of any bailout that the global lender could offer.

“The IMF is significant because all the other players are looking towards it,” he noted.

Khan highlighted that the traditional supporters of Pakistan’s economy – China and the Gulf countries – were also looking at the IMF as a credible option.

However, the IMF as an umbrella could not work this time.

Despite the successful completion of the last Stand-By Arrangement, neither did the foreign commercial banks give new loans to the government, nor did the international credit agencies improve Pakistan’s junk rating.

Khan said the IMF as an umbrella would work only along with other sets of reforms that were needed to remove the distortions of the economy to bring investment in the productive sectors.

“The IMF is not responsible for this crisis because Pakistanis consume a lot more than what they produce.”

The FCDO chief economist said the IMF programme was meant only for short-term stabilisation to stop the bleeding but that alone was not sufficient and Pakistan would have to treat the deeper root causes of the problem.

Pakistan’s economy for the past few years is in a phase where it cannot pay its debts. Debt servicing alone is consuming about 60% of Pakistan’s revenues. The current level of revenue generation is not enough to pay off the country’s piling debt.

Khan noted that countries had used the IMF programme to undertake long-term reforms.

“If Pakistan can do that, it can exit the IMF programme at some stage.”

Foreign investment

The FCDO chief economist also spoke about the investment conditions in Pakistan.

“If there are productive opportunities in the economy, domestic and foreign investors will obviously invest.”

Khan pointed out that the challenge was that the international investors were looking at the domestic ones but the latter were sitting on the fence.

“The domestic investors are interested but they also want to see where the economy will go in terms of its fundamentals and whether or not the government is serious about reforms.”

Khan made these observations after meeting with Pakistani business circles in Lahore and Karachi — the two main industrial centres of the country.

“The domestic investors are in in a wait and see mode as they don’t want to lose their money.”

The FCDO official said the only way a country could grow was when its citizens and the rulers, including the elite class, take charge of their destiny.

“There is no case in history where outside actors have come and transformed the country and that is also true for Pakistan.”

Khan said any external investment was good for short-term stabilisation but the key question was whether it was made in the more productive sectors or not.

“The Investment should be in the export sectors. If it goes into the less productive sectors of the economy, then it’s a different story,” the FCDO chief economist responded when asked about the potential Saudi Arabian investment in Pakistan.

“Foreign investors would first ask the question: if these are productive sectors, why aren’t the domestic ones investing in them.”

Khan was of the view that Pakistan should not channel foreign investment into the energy sector given the idle capacity charges and surplus electricity.

Pakistan has offered two projects having a cumulative generation capacity of 1,920 megawatts to Saudi Arabia.

“Energy should be one of the lowest priority areas given the needs of the other sectors,” the FCDO official added.

Narrow tax base

Khan said the 10% tax-to-GDP ratio was not sufficient to meet the needs of Pakistan’s economy.

“This tax regime is not incentivising investment in the productive sectors.”

More than half of the economy is not taxed or very lightly taxed which includes the agriculture; wholesale and retail, and real estate sectors.

Manufacturing is paying three times more than its size in taxes while retail and wholesale pays just 3%.

The real estate sector is paying just 0.01% — discouraging investment in productive sectors.

Khan emphasised that good tax systems are more just and progressive.

“In Pakistan, the bottom 10% of the citizens — the poorest people — pay a bigger proportion of their income in taxes against the richest 10%. This is regressive taxation.”

Two-third of the taxes is generated indirectly. The poor spend more on consumption and that is why they end up paying more taxes.

The FCDO official said Pakistan’s tax system was so “inefficient” that it was leading to more burden on the people that were already in the tax net — either the salaried class or the manufacturing sector.

To a question, Khan said the exchange rate alone could not help in boosting exports.

“There is a need to make the Pakistani firms competitive to enhance exports by withdrawing protection. The industrial sector should also step up to boost exports as they are making easier money here.”

What Pakistan needs to do?

Khan noted that there was a consensus that difficult reforms were needed to be undertaken but they were costly.

“The people are waiting to see what measures the government will take and the policies it will adopt.”

He advised the government to pick a few policies to send a signal that it was serious.

“My advice to the Pakistani prime minister will be that there is a need to change the fiscal policies, which are also linked to structural policies and more importantly invest in human capital,” the FCDO chief economist said.

“The stunting rate is 40%. Investing in people is very important.”

Khan observed that Pakistan had not been investing in human capital for long and its deficit was becoming bleaker.

He vowed that the FCDO would try its best to help Pakistan in the shape of technical assistance and advice.